Home Equity Line of Credit (HELOC)

Renovation? Consolidation? Put your home to work.

Renovation? Consolidation? Put your home to work.

Get the affordable financing you need with the flexibility to use it as you need it. Like a home equity loan, a Home Equity Line of Credit(1) puts your home to work for you, securing funds to use as you see fit.

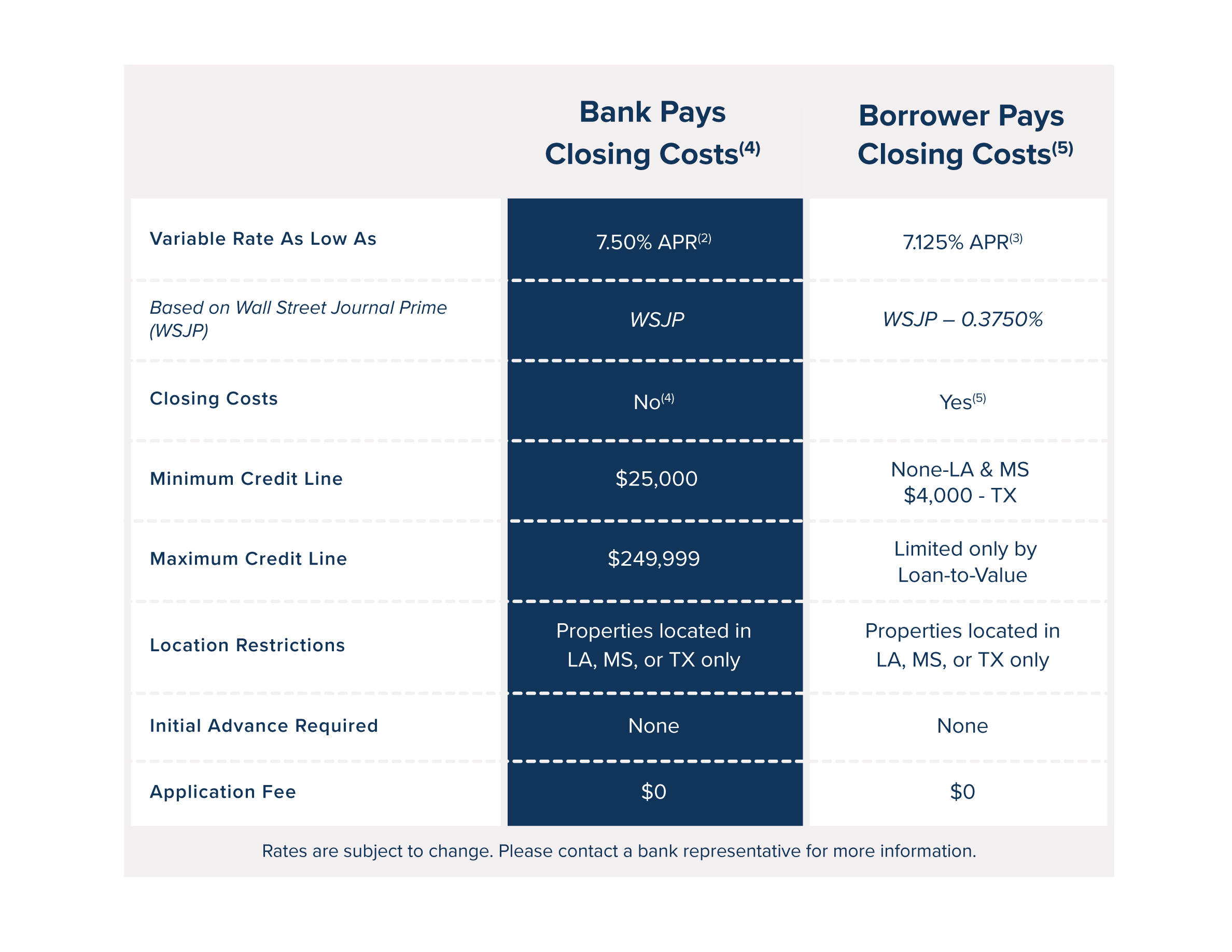

Home Bank offers two products for you to choose from. Pick the one that fits your needs:

About HELOCs:

- Based on home's value

- Use funds for most anything

- Variable interest rate(3,4)

- Borrow only what you need

- Pay interest on only what you use

- Easy access to funds when you need it

- Interest may be tax deductible(6)

- Pay it down and use it again during draw period

- Local decisions, processing, and service

1) Home Equity Lines of Credit (HELOCs) are available to qualified consumer applicants on new HELOCs for owner-occupied conforming residential real property in first or second lien position, up to an 85% maximum loan to value (LTV) for primary residences in Louisiana and Mississippi and 80% maximum LTV in Texas. Offer is not available on refinancing of existing Home Bank debt. Second liens may not be written behind an existing HELOC. The line of credit may not be used to purchase property being used as collateral. The term of this revolving line of credit is 25 years (first 10 years: interest-only payments; last 15 years: principal and interest payments). No draws in last 15 years when Home Bank pays the closing cost. There is no minimum credit line amount if the borrower pays closing costs in Louisiana and Mississippi and a $4,000 minimum credit line in Texas. Rescission rights may temporarily restrict availability of funds. Offer effective 05/09/2025, to qualified borrowers.

2) Balances will accrue at Wall Street Journal Prime, currently 7.50% as of 12/19/24 for the highest qualified borrowers (currently 7.175%), subject to a 4.00% rate floor. An interest rate floor is the minimum interest rate that can be charged. The margin and resulting Annual Percentage Rate (APR) are determined based on creditworthiness, property type and occupancy. The APR will vary but will not exceed 21%. There is no limit on the amount by which the rate can change in any one-year period.

3) Balances will accrue at Wall Street Journal Prime, currently 7.50% as of 12/19/24 minus a margin of 0.3750% for the highest qualified borrowers (currently 7.175%), subject to a 4.00% rate floor. An interest rate floor is the minimum interest rate that can be charged. The margin and resulting Annual Percentage Rate (APR) are determined based on creditworthiness, property type and occupancy. The APR will vary but will not exceed 21%. There is no limit on the amount by which the rate can change in any one-year period.

4) Standard closing costs range from $500 to $2,500. The bank pays closing costs as follows: attorney fees, title opinion and update, mortgage recordation fees, third-party property evaluations, and appraisal management company fees. Applicant pays for any full property appraisal that may be necessary. Appraisal costs range from $100 - $550. Orleans Parish residents pay a documentary tax fee. For first lien loans of $100,000 or more, applicants will pay a one-time tax-tracking fee, not to exceed $105. In Louisiana and Mississippi, a $50 line fee applies after year one and annually thereafter. There is no annual fee for Texas borrowers. Property insurance is required; if collateral is determined to be in an area having special flood hazards, flood insurance will also be required. In Louisiana and Mississippi, if you terminate the line of credit within 12 months from the account opening date, an early closure fee equal to bank-paid closing costs will be charged back to your line. In all states, if you do not close on your HELOC for any reason, you will reimburse Home Bank for the actual cost of any third-party charges paid by the bank in connection with setting up your HELOC.

5) Standard closing costs range from $500 to $2,500 and include: attorney fees, title opinion and update, mortgage recordation fees, third-party property evaluations, and appraisal management company fees. Applicant pays for any full property appraisal that may be necessary. Appraisal costs range from $100 - $550. Orleans Parish residents pay a documentary tax fee. For first lien loans of $100,000 or more, applicants will pay a one-time tax-tracking fee, not to exceed $105. In Louisiana and Mississippi, a $50 line fee applies after year one and annually thereafter. There is no annual fee for Texas borrowers. Property insurance is required; if collateral is determined to be in an area having special flood hazards, flood insurance will also be required. In Louisiana and Mississippi, if you terminate the line of credit within 12 months from the account opening date, an early closure fee equal to bank-paid closing costs will be charged back to your line. In Texas, there is no early closure fee. In all states, if you do not close on your HELOC for any reason, you will reimburse Home Bank for the actual cost of any third-party charges paid by the bank in connection with setting up your HELOC.

6) Please consult your tax advisor regarding deductibility of interest and other costs.

Important Information for Texas Residents: Texas laws impose certain restrictions on lines secured by a lien on your home. In Texas, each individual advance from your line of credit must be in an amount of at least $4,000. The maximum amount of your new home equity line, when combined with the dollar amount of all other liens on your home, may not exceed 80% of the fair market value of your home on the date your home equity line is made. Only one home equity line is allowed on the home at a time and no more than one home equity line may be made on the home within a 12-calendar month period. Other restrictions apply.

Terms are subject to change. Refer to your Home Bank representatives for more details.

Skip to content

Skip to content